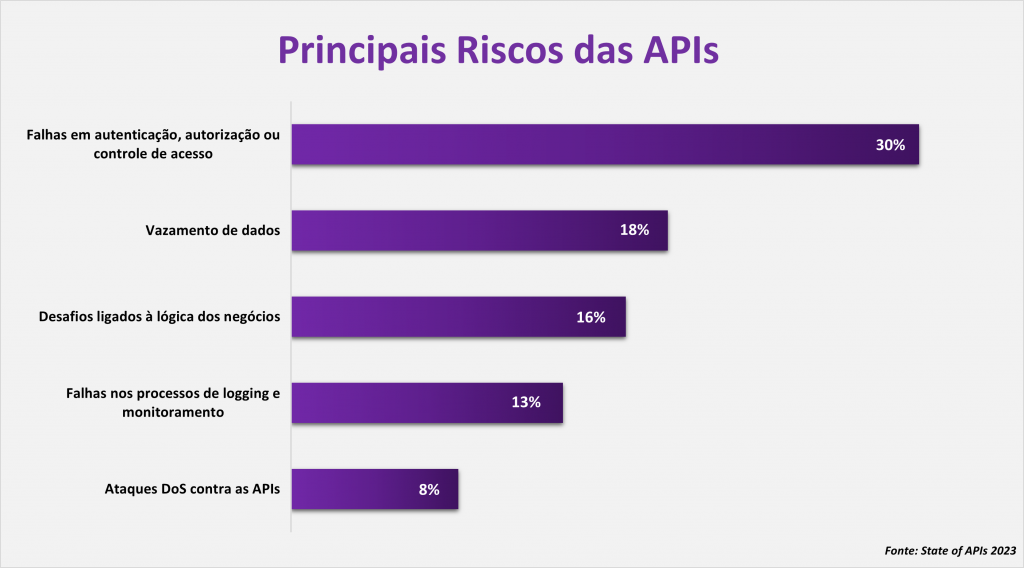

F5 fatura 703 milhões de dólares no trimestre, um crescimento de 4% em relação a 2022

- Dedicada a proteger aplicações e APIs, a empresa avançou, ainda, 8% na venda de segurança como serviço;

- O quarto e último trimestre do ano fiscal da F5 – julho, agosto e setembro de 2023 – deve chegar a marcas que ficam entre USD 690 e 710 milhões de dólares.

A F5, Inc. (NASDAQ: FFIV), líder em soluções que garantem a segurança e a entrega de aplicações corporativas, anuncia o faturamento de 703 milhões de dólares no período de abril, maio e junho de 2023 – o terceiro trimestre do ano fiscal da empresa. Isso representa um crescimento de 4% em relação ao mesmo período do ano passado, quando a empresa atingiu a marca de USD 674 milhões. Merece destaque, ainda, o fato de que a receita de serviços globais (security as a service) cresceu 8% em relação ao mesmo período em 2022. A receita de produtos, por outro lado, cresceu 1%, contribuindo para o crescimento de 5% em sistemas (appliances) e software.

O ano fiscal da F5 iniciou-se no dia 1 de outubro de 2022.

“Em um ambiente desafiado pela incerteza macroeconômica, nossa equipe está tendo um bom desempenho, entregando receita no ponto médio da nossa faixa de orientação e lucro por ação bem acima do limite superior da nossa faixa de orientação”, disse François Locoh-Donou, Presidente e CEO da F5. “Estamos vendo alguns sinais iniciais de estabilização da demanda. Os clientes procuram a F5 para ajudá-los a proteger e otimizar as aplicações e APIs que impulsionam seus negócios”.

Perspectiva de negócios

“Ao longo dos anos recentes, combinando inovação orgânica, aquisições e integração de tecnologia, criamos um portfólio convergente capaz de simplificar as complexidades que nossos clientes enfrentam operando nos ambientes de TI híbridos e multinuvem de hoje”, continuou Locoh-Donou. “Estamos entregando a melhoria da margem bruta e a alavancagem operacional com as quais nos comprometemos. Seguimos confiantes em nossa capacidade de atingir nossa meta de crescimento de ganhos não-GAAP de dois dígitos no ano fiscal de 2023.”

Para o quarto trimestre do ano fiscal de 2023, a F5 espera gerar receita na faixa de USD 690 milhões a USD 710 milhões, com ganhos não-GAAP na faixa de USD 3,15 a USD 3,27 por ação diluída.

Resumo do desempenho do terceiro trimestre

O lucro bruto GAAP no terceiro trimestre do ano fiscal de 2023 foi de USD 561 milhões, representando uma margem bruta GAAP de 79,8%. Isso se compara ao lucro bruto GAAP de USD 544 milhões no mesmo período do ano anterior, que representou uma margem bruta GAAP de 80,6%. O lucro bruto não-GAAP no terceiro trimestre do ano fiscal de 2023 foi de USD 579 milhões, representando uma margem bruta não-GAAP de 82,5%. Isso se compara ao lucro bruto não-GAAP de USD 561 milhões no mesmo período do ano anterior, que representou uma margem bruta não-GAAP de 83,2%.

O lucro operacional GAAP do período foi de USD 104 milhões, representando uma margem operacional GAAP de 14,7%. Isso se compara ao lucro operacional GAAP de USD 107 milhões no mesmo período do ano anterior, que representou uma margem operacional GAAP de 15,9%. O lucro operacional não-GAAP do período foi de USD 233 milhões, representando uma margem operacional não-GAAP de 33,2%. Isso se compara ao lucro operacional não-GAAP de USD 194 milhões no mesmo período do ano anterior, que representou uma margem operacional não-GAAP de 28,8%.

O lucro líquido GAAP no terceiro trimestre do ano fiscal de 2023 foi de USD 89 milhões, ou USD 1,48 por ação diluída, em comparação com USD 83 milhões, ou USD 1,37 por ação diluída, no terceiro trimestre do ano fiscal de 2022. O lucro líquido não-GAAP no terceiro trimestre do ano fiscal de 2023 foi de USD 194 milhões, ou USD 3,21 por ação diluída, em comparação com USD 155 milhões, ou USD 2,57 por ação diluída, no ano fiscal de 2022.

All forward-looking non-GAAP measures included in the Company’s business outlook exclude estimates for amortization of intangible assets, share-based compensation expenses, significant effects of tax legislation and judicial or administrative interpretation of tax regulations (including the impact of income tax reform), non-recurring income tax adjustments, valuation allowance on deferred tax assets, and the income tax effect of non-GAAP exclusions, and do not include the impact of any future acquisitions or divestitures, acquisition-related charges and write-downs, restructuring charges, facility exit costs, or other non-recurring charges that may occur in the period. F5 is unable to provide a reconciliation of non-GAAP earnings guidance measures to corresponding U.S. generally accepted accounting principles or GAAP measures on a forward-looking basis without unreasonable effort due to the overall high variability and low visibility of most of the foregoing items that have been excluded. Material changes to any one of these items could have a significant effect on our guidance and future GAAP results. Certain exclusions, such as amortization of intangible assets and share-based compensation expenses, are generally incurred each quarter, but the amounts have historically varied and may continue to vary significantly from quarter to quarter.

GAAP Measures

| Q3 FY2023 | Q3 FY2022 | |

| Revenue | $703M | $674M |

| Gross profit | $561M | $544M |

| Gross margin | 79.8% | 80.6% |

| Operating profit | $104M | $107M |

| Operating margin | 14.7% | 15.9% |

| Net income | $89M | $83M |

| EPS | $1.48 | $1.37 |

Non-GAAP Measures

| Q3 FY2023 | Q3 FY2022 | |

| Gross profit | $579M | $561M |

| Gross margin | 82.5% | 83.2% |

| Operating profit | $233M | $194M |

| Operating margin | 33.2% | 28.8% |

| Net income | $194M | $155M |

| EPS | $3.21 | $2.57 |

A reconciliation of GAAP to non-GAAP measures is included in the attached Consolidated Income Statements. Additional information about non-GAAP financial information is included in this release.

Forward Looking Statements

This press release contains forward-looking statements including, among other things, statements regarding F5’s future financial performance including revenue, revenue growth, gross margins, operating leverage, earnings growth, future customer demand and spending, markets, and the performance and benefits of the Company’s products. These, and other statements that are not historical facts, are forward-looking statements. These forward-looking statements are subject to the safe harbor provisions created by the Private Securities Litigation Reform Act of 1995. Actual results could differ materially from those projected in the forward-looking statements as a result of certain risk factors. Such forward-looking statements involve risks and uncertainties, as well as assumptions and other factors that, if they do not fully materialize or prove correct, could cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to: customer acceptance of offerings; continued disruptions to the global supply chain resulting in inability to source required parts for F5’s products or the ability to only do so at greatly increased prices thereby impacting our revenues and/or margins; global economic conditions and uncertainties in the geopolitical environment; overall information technology spending; F5’s ability to successfully integrate acquired businesses’ products with F5 technologies; the ability of F5’s sales professionals and distribution partners to sell new solutions and service offerings; the timely development, introduction and acceptance of additional new products and features by F5 or its competitors; competitive factors, including but not limited to pricing pressures, industry consolidation, entry of new competitors into F5’s markets, and new product and marketing initiatives by our competitors; increased sales discounts; the business impact of the acquisitions and potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement of completion of acquisitions; uncertain global economic conditions which may result in reduced customer demand for our products and services and changes in customer payment patterns; litigation involving patents, intellectual property, shareholder and other matters, and governmental investigations; potential security flaws in the Company’s networks, products or services; cybersecurity attacks on its networks, products or services; natural catastrophic events; a pandemic or epidemic; F5’s ability to sustain, develop and effectively utilize distribution relationships; F5’s ability to attract, train and retain qualified product development, marketing, sales, professional services and customer support personnel; F5’s ability to expand in international markets; the unpredictability of F5’s sales cycle; the ability of F5 to execute on its share repurchase program including the timing of any repurchases; future prices of F5’s common stock; and other risks and uncertainties described more fully in our documents filed with or furnished to the Securities and Exchange Commission, including our most recent reports on Form 10-K and Form 10-Q and current reports on Form 8-K and other documents that we may file or furnish from time to time, which could cause actual results to vary from expectations. The financial information contained in this release should be read in conjunction with the consolidated financial statements and notes thereto included in F5’s most recent reports on Forms 10-Q and 10-K as each may be amended from time to time. All forward-looking statements in this press release are based on information available as of the date hereof and qualified in their entirety by this cautionary statement. F5 assumes no obligation to revise or update these forward-looking statements.

GAAP to non-GAAP Reconciliation

F5’s management evaluates and makes operating decisions using various operating measures. These measures are generally based on the revenues of its products, services operations, and certain costs of those operations, such as cost of revenues, research and development, sales and marketing and general and administrative expenses. One such measure is GAAP net income excluding, as applicable, stock-based compensation, amortization and impairment of purchased intangible assets, facility-exit costs, acquisition-related charges, net of taxes, restructuring charges, and certain non-recurring tax expenses and benefits, which is a non-GAAP financial measure under Section 101 of Regulation G under the Securities Exchange Act of 1934, as amended. This measure of non-GAAP net income is adjusted by the amount of additional taxes or tax benefit that the Company would accrue if it used non-GAAP results instead of GAAP results to calculate the Company’s tax liability.

The non-GAAP adjustments, and F5’s basis for excluding them from non-GAAP financial measures, are outlined below:

Stock-based compensation. Stock-based compensation consists of expense for stock options, restricted stock, and employee stock purchases through the Company’s Employee Stock Purchase Plan. Although stock-based compensation is an important aspect of the compensation of F5’s employees and executives, management believes it is useful to exclude stock-based compensation expenses to better understand the long-term performance of the Company’s core business and to facilitate comparison of the Company’s results to those of peer companies.

Amortization and impairment of purchased intangible assets. Purchased intangible assets are amortized over their estimated useful lives, and generally cannot be changed or influenced by management after the acquisition. On a non-recurring basis, when certain events or circumstances are present, management may also be required to write down the carrying value of its purchased intangible assets and recognize impairment charges. Management does not believe these charges accurately reflect the performance of the Company’s ongoing operations; therefore, they are not considered by management in making operating decisions. However, investors should note that the use of intangible assets contributed to F5’s revenues earned during the periods presented and will contribute to F5’s future period revenues as well.

Facility-exit costs. F5 has incurred charges in connection with the exit of facilities as well as other non-recurring lease activity. These charges are not representative of ongoing costs to the business and are not expected to recur. As a result, these charges are being excluded to provide investors with a more comparable measure of costs associated with ongoing operations.

Acquisition-related charges, net. F5 does not acquire businesses on a predictable cycle and the terms and scope of each transaction can vary significantly and are unique to each transaction. F5 excludes acquisition-related charges from its non-GAAP financial measures to provide a useful comparison of the Company’s operating results to prior periods and to its peer companies. Acquisition-related charges consist of planning, execution and integration costs incurred directly as a result of an acquisition.

Restructuring charges. F5 has incurred restructuring charges that are included in its GAAP financial statements, primarily related to workforce reductions and costs associated with exiting facility-lease commitments. F5 excludes these items from its non-GAAP financial measures when evaluating its continuing business performance as such items vary significantly based on the magnitude of the restructuring action and do not reflect expected future operating expenses. In addition, these charges do not necessarily provide meaningful insight into the fundamentals of current or past operations of its business.

Management believes that non-GAAP net income per share provides useful supplemental information to management and investors regarding the performance of the Company’s core business operations and facilitates comparisons to the Company’s historical operating results. Although F5’s management finds this non-GAAP measure to be useful in evaluating the performance of the core business, management’s reliance on this measure is limited because items excluded from such measures could have a material effect on F5’s earnings and earnings per share calculated in accordance with GAAP. Therefore, F5’s management will use its non-GAAP earnings and earnings per share measures, in conjunction with GAAP earnings and earnings per share measures, to address these limitations when evaluating the performance of the Company’s core business. Investors should consider these non-GAAP measures in addition to, and not as a substitute for, financial performance measures in accordance with GAAP.

F5 believes that presenting its non-GAAP measures of earnings and earnings per share provides investors with an additional tool for evaluating the performance of the Company’s core business and is used by management in its own evaluation of the Company’s performance. Investors are encouraged to look at GAAP results as the best measure of financial performance. However, while the GAAP results are more complete, the Company provides investors these supplemental measures since, with reconciliation to GAAP, it may provide additional insight into the Company’s operational performance and financial results.

For reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, please see the section in our attached Condensed Consolidated Income Statements entitled “Non-GAAP Financial Measures.”

###

Sobre a F5

A F5 (NASDAQ: FFIV) oferece às empresas mais importantes do mundo, provedores de serviços, governos e marcas voltadas para o consumo a liberdade de fornecerem todas as aplicações de maneira segura, em qualquer lugar, e com a confiança de que precisam. A F5 cria uma camada de serviços para as aplicações que inclui criptografia e segurança e permite que as organizações adotem a infraestrutura de sua escolha sem sacrificar a velocidade e o controle. Para obter mais informações, acesse f5.com. Você também pode nos seguir em @f5_latam no Twitter ou nos visitar no LinkedIn, Facebook e Instagram para saber mais sobre a F5, seus parceiros e tecnologias. F5 e BIG-IP são marcas comerciais ou marcas de serviço da F5, Networks Inc. nos Estados Unidos e em outros países. Todos os outros nomes de produtos e empresas incluídos aqui podem ser marcas comerciais de seus respectivos proprietários.